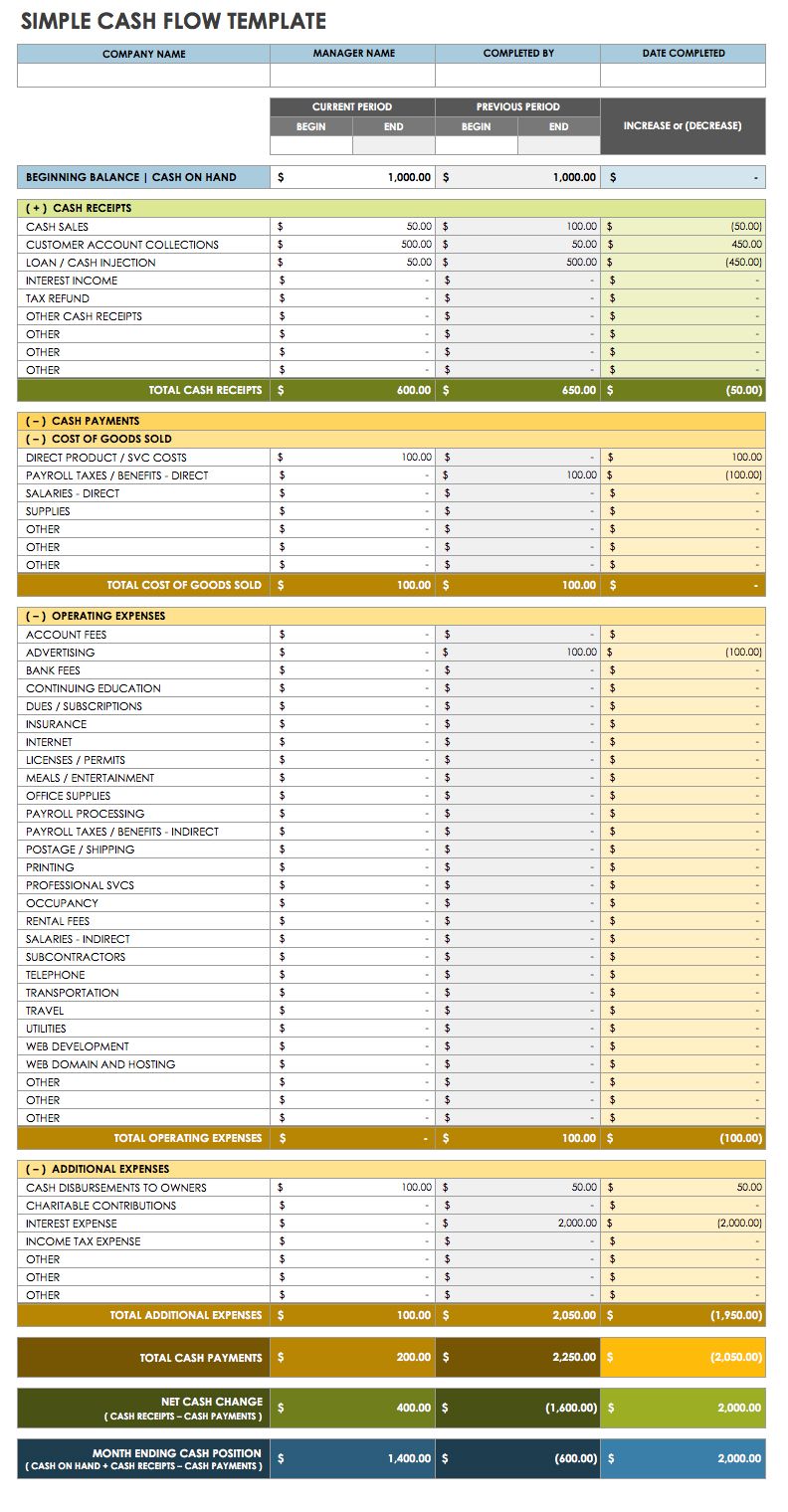

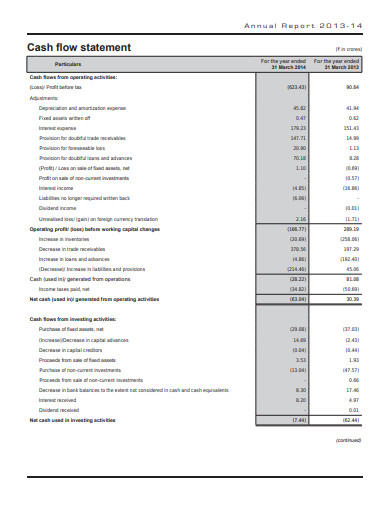

The cash flow statement reports the cash flowing into your business through sales and the cash flowing out of the business through expenses and other financial obligations. By digging into all three financial reports, investors, lenders, founders, and managers can objectively assess your startup's financial health and effectiveness at any given point in time. The three most critical financial reports for startups are the balance sheet, the income statement, and the cash flow statement.

The two primary ways of calculating the cash flow of your startup are the direct and indirect methods.The cash flow statement elements include the cash from operating activities, investing activities, and financing activities.By measuring your startup’s cash inflows and outflows, you can objectively measure how well it generates cash, pays its obligations, and funds current and future operating expenses.Simply, a cash flow statement tracks the cash coming in and going out of the startup over a certain period.

The cash flow statement reports the cash flowing into the startup through sales and the cash flowing out through expenses and other financial obligations.

By digging into all three financial reports, investors, lenders, founders, and managers can objectively assess a startup's financial health and effectiveness at any given point in time.For your startup, the three most critical financial reports are: the balance sheet, the income statement, and the cash flow statement.

0 kommentar(er)

0 kommentar(er)